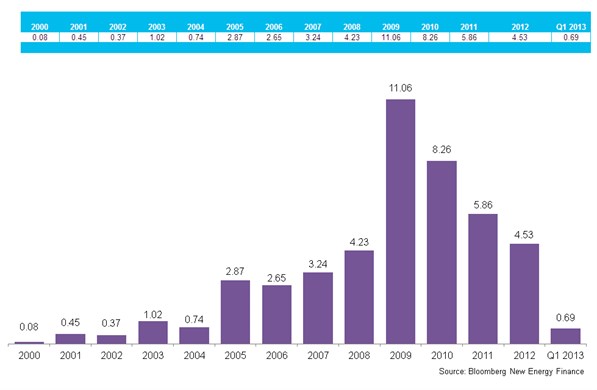

The Government’s Electricity Market Reform, a central pillar of the Energy Bill currently progressing through Parliament designed to encourage new, much-needed sources of low-carbon power generation to be built, is gathering pace. But, despite a slew of recent announcements providing some further detail on how the reforms will work, investment in renewables is slowing down dramatically, as this recent graph from Bloomberg, showing clean energy investment decisions (in US$bn), clearly demonstrates:

So what’s impeding investment and what can be done to alleviate some of the problem?

Uncertainty

In order to take forward renewables projects, developers need clarity over their expected revenues so that they can obtain finance and develop projects. Through Electricity Market Reform, the existing Renewables Obligation (RO) support mechanism is being replaced by Contracts for Difference (CfDs), with access to the RO closed to all projects which first generate after March 2017.

The 2017 cut-off date for access to the RO has created a ‘cliff edge’ for projects. Developers which are currently uncertain about whether their project will be in a position to generate before that date (this is already the case for some) will simply not be able to make an investment decision until there is a full understanding of the new CfDs.

Unfortunately, although draft strike prices for CfDs have now been published, policy uncertainty is being prolonged by the inherent complexity of CfDs, as well as the potential difficulties in gaining State Aid clearance at EU level. This means that the CfD will not be up and running until the end of 2014 at the earliest, with delays to this timetable likely to mean slippage into 2015.

All this uncertainty is leading to an investment ‘freeze’ across the industry for those projects that are not certain to commission under the RO by March 2017. This will intensify throughout 2013 as more projects reach the stage at which significant development investment is needed and will last until these projects have the clarity they need about CfDs, or an alternative solution is found. The offshore wind industry is already beginning to feel the effects of this freeze and it is likely to begin impacting on onshore wind next year.

Preventing the freeze– ‘Investment Contracts’

To try to prevent this investment freeze, the Government proposes to offer early CfDs, known as Investment Contracts, to projects which find themselves in this position.

We fully support the intention behind Investment Contracts. As with the enduring CfD regime, Investment Contracts will need to have an appropriate ‘strike price’ and contract terms before developers can invest. However, if these issues can be resolved (and this remains a big 'if') then, in theory, Investment Contracts would allow those projects needing to make significant investment decisions in the 18 months between now and the earliest operation of the CfD regime to continue development.

But there is a significant catch. Investment Contracts also need State Aid approval at EU level before they can become ‘bankable’. Until this has been granted, developers with Investment Contracts will still not invest. The current government timetable envisages State Aid clearance for investment contracts by March 2014 – just 2-3 months after the final CfD strike prices have been agreed. This appears to be an extremely ambitious if not unprecedented timescale and there is a very real risk that State Aid approval for both CfDs and Investment Contracts will be delayed, possibly into 2015.

In this scenario the freeze which Investment Contracts are designed to prevent would continue. And currently there is no ‘Plan B’ in place.

Plan B

The Government must therefore develop a ‘Plan B’ to prepare for the eventuality that delays to State Aid approval make Investment Contracts ineffective. Looking at the problem of Investment Contracts in isolation, the simplest option is to extend access the RO to 2020 (it currently closes to new projects on 1st April 2017) to those projects which are being forced to postpone investment until State Aid has been approved. This would be a ‘no regrets’ measure – if Investment Contracts and CfDs are approved in good time then it will not be required; but, if there are delays, there is an alternative, proven support mechanism available that would enable investment to continue until approval is granted.

Extending access to the RO would also provide an alternative if the CfD ultimately proves unworkable or uninvestable, both of which are possibilities due to the inherent complexity of the mechanism. This access would only be allowed in a scenario where the CfD failed.

This simple, no-regrets measure would therefore help to provide significant reassurances to developers and the supply chain if the worst was to happen. This certainty is what EMR was originally designed to provide and is vital to assure continued investment. Without this type of long-term certainty, the big freeze in investment will only deepen.